Law360 (December 19, 2024, 3:42 PM EST)

As American dealmakers hunt for ways to streamline their transactions and prepare for President-elect Donald Trump to take office, it may finally be time to give the lockbox a closer look.

A mechanism for setting the purchase price based on historical financials and eliminating postclosing price adjustments, the lockbox is a common practice in European private equity transactions. A good option for strategic acquirers, the lockbox is still surprisingly rare in U.S.-to-U.S. deals.

Despite its name, the lockbox is not a financial product or service, but rather a contractual framework that provides certainty by fixing the price at signing.

By addressing the distinct objectives of both private equity sponsors and strategic corporate buyers, the lockbox mechanism offers more than just a nice-to-have. It can deliver price certainty, reduce negotiation drag, and allow postclosing efforts to focus on integration and growth rather than rehashing numbers.

If you're weary of the familiar friction points built into U.S.-style postclosing adjustments, consider how a lockbox might help you avoid the usual pitfalls.

Understanding the Lockbox Mechanism

In a traditional U.S. merger and acquisition deals, the price you pay on closing day is only provisional. Both sides agree on a target working capital figure at signing, but the final purchase price often hinges on a postclosing adjustment once actual working capital is calculated.

While this method is designed to protect against paying for assets or liquidity that don't materialize, it can inadvertently create a free-money dynamic: buyers may be incentivized to dispute the final purchase price if the potential settlement or adjustment outweighs the cost of pursuing it.

These disputes often delay synergy capture, add unnecessary cost, and strain relationships at a time when the focus should be on integration and growth.

The lockbox mechanism turns this approach on its head. Instead of tinkering with the price after the deal closes, the parties lock in a purchase price at signing, based on a historical balance sheet known as the "locked box date."

From that date forward, the buyer is treated as the economic owner. By eliminating postclosing adjustments, the lockbox removes the temptation to revisit the price already paid, fostering a more collaborative transition.

Sellers, meanwhile, agree to preserve value through clear leakage provisions — covering items like dividends, affiliate payments or other so-called leakage — and back these commitments with clear contractual remedies. With the groundwork for disputes substantially reduced, both sides can immediately focus on executing the buyer's strategic plan.

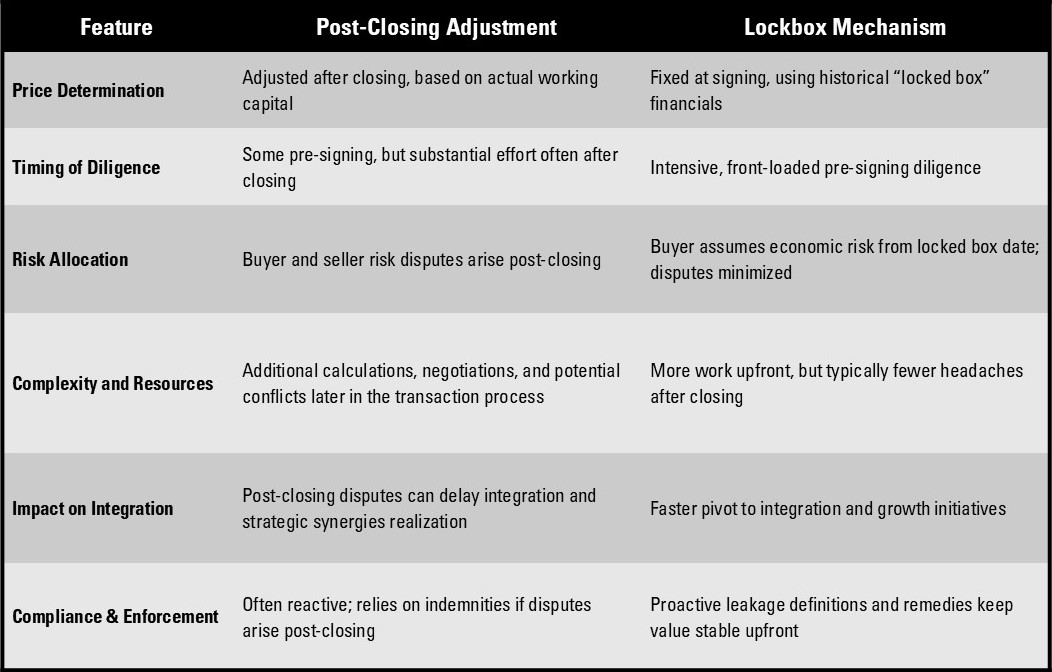

By seeing the differences side-by-side, it's clear how the lockbox's emphasis on clarity and upfront diligence can eliminate the often fraught environment that sometimes accompanies working capital adjustments.

The mechanism not only prevents postclosing friction but also eliminates the cost/benefit calculus of disputing the price post-closing — an approach particularly appealing to both private equity sponsors and strategic buyers seeking a smoother and more predictable process.

Regulatory and Market Context

In today's dynamic M&A landscape, the regulatory environment appears to be on the brink of transformation under Trump's administration. With anticipated leadership changes at key agencies such as the SEC, where Paul Atkins is expected to take the helm, speculation about a shift toward a lighter enforcement approach is gaining traction.

Atkins, a former SEC commissioner known for advocating a principles-based approach to regulation and a focus on reducing compliance burdens, represents a potential pivot from the stricter enforcement priorities championed by his predecessors, such as Gary Gensler.

While these changes could signal a broader easing of regulatory pressures, the market's demand for transparent and defensible deal structures remains steadfast. Boards, audit committees and investors continue to prioritize rigorous valuation practices, and the lockbox mechanism answers this call by anchoring purchase prices in thoroughly vetted, historically verified financial data.

This demand for robust deal structures is further supported by the ongoing convergence of U.S. Generally Accepted Accounting Principles and International Financial Reporting Standards.

Developed by the Financial Accounting Standards Board, U.S. GAAP is a rules-based system offering detailed guidelines for financial reporting. In contrast, IFRS, established by the International Accounting Standards Board, is principles-based, focusing on broader interpretations to achieve consistency across global markets.

Efforts to harmonize these frameworks have been underway for decades, driven by the need to simplify cross-border transactions and enhance the comparability of financial statements in an increasingly globalized economy. Currently, over 140 jurisdictions require or permit the use of IFRS for public companies, reflecting its widespread acceptance.

While some may assume that an administration favoring domestic priorities, such as Trump's, might scale back these initiatives, the reality is that harmonization has been led by global financial markets, not individual governments.

This enduring momentum makes it unlikely that the convergence process will be derailed, as it reflects the collective demands of multinational corporations, investors and regulators seeking consistent, transparent accounting standards worldwide.

The lockbox mechanism naturally aligns with this convergence by leveraging historical financials that are prepared under robust accounting standards to deliver greater clarity and certainty in deal valuations.

Private equity sponsors, under pressure from limited partners to demonstrate valuation discipline, benefit from the lockbox's ability to streamline transactions and reduce postclosing disputes.

Strategic buyers, too, gain from the certainty and efficiency it offers, allowing them to model synergies and integrate acquisitions without the distraction of trailing financial debates.

By eliminating postclosing adjustments and providing a proactive framework for valuation, the lockbox not only aligns with evolving demands for accountability but also enhances deal execution in any regulatory climate.

Freed from the complexities of traditional U.S.-style adjustments, dealmakers can focus on achieving the growth and strategic goals that define the transaction's value.

Why Lockbox Works for Both Private Equity and Strategic Buyers

Private Equity Buyers

For private equity sponsors, time is money. A lockbox lets them firm up value early, minimize the risk of working capital wrangling and focus immediately on driving returns. Without lingering disputes, resources can shift straight from deal mechanics to portfolio company optimization, often improving internal rates of return.

Meanwhile, presenting a lockbox structure can show bidders, if the private-equity firm is selling, that the financials are robust, potentially boosting pricing tension in a competitive process.

Strategic Buyers

Strategic acquirers gain a stable baseline from which to model synergies, making it easier to justify the purchase price internally and plan integration without the distraction of a potential second financial debate months down the road. With price locked in and no trailing negotiations over inventory, receivables, or similar items, the buyer's team can hit the ground running.

Moreover, by avoiding contentious disputes, strategic buyers can preserve goodwill with key managers or stakeholders, facilitating smoother transitions and accelerating the path to realizing their strategic objectives. These key stakeholders — whether they are critical managers, employees or even the sellers themselves — often play an essential role in ensuring a successful integration and in driving the long-term value of the transaction

When The Lockbox Mechanism Makes Sense

A lockbox structure works best when the target's financials are reliable, fairly consistent and predictable. Think audited, or at least reviewed, financial statements with clear, stable working capital patterns — no surprise payables lurking off-balance sheet and no wild fluctuations in receivables from month to month.

Targets that have recently undergone clean audits, boast robust internal controls or show steady, well-documented revenue streams set the stage for a successful lockbox implementation.

On the operational side, a business with predictable inventory turnover, stable cost structures, and well-established relationships with customers and suppliers helps both buyer and seller trust the locked box date's snapshot of value.

Conversely, some scenarios do not lend themselves to a lockbox. Hyper-growth companies without mature accounting systems or those facing volatile seasonal cycles may find it difficult to present a convincing locked box balance sheet.

Industries characterized by rapid innovation and unpredictable growth trajectories, such as artificial intelligence or renewable energy, often lack the financial predictability needed for this structure. Similarly, targets undergoing major restructuring or grappling with known but unquantified liabilities could complicate the fixed-price premise.

Being candid about these limitations ensures that the lockbox mechanism is deployed where it truly can deliver cleaner deal executions and stronger outcomes for both private equity and strategic acquirers.

Market Maturity and Competitive Pressures

Although I first encountered the lockbox mechanism stateside more than two decades ago, it remains rare in U.S.-to-U.S. deals. Yet today's market dynamics are fundamentally different. Private equity firms face intense pressure to deploy capital quickly and efficiently, while strategic buyers compete against increasingly sophisticated financial sponsors.

In this environment, the lockbox structure offers a compelling edge: By eliminating postclosing working capital adjustments, buyers can present cleaner, more decisive offers that stand out in competitive processes.

This shift parallels the rapid adoption of representations and warranties insurance, which has reshaped the negotiation of indemnities in M&A transactions. Just as RWI has reduced friction between buyers and sellers by transferring certain risks to an insurer, the lockbox mechanism reduces the potential for postclosing disputes by locking in the purchase price upfront.

Both innovations streamline the transaction process, enhance deal certainty, and allow buyers and sellers to focus on achieving their strategic objectives rather than getting bogged down in prolonged negotiations or financial reconciliations.

As more U.S. dealmakers gain exposure to European practices through cross-border transactions, the efficiency and certainty of the lockbox approach may finally overcome historical inertia. With pressure mounting to streamline deals and reduce postclosing friction, the time seems ripe for broader adoption of this tested approach.

Practical Tips for Negotiating and Implementing a Lockbox

Explore frontload due diligence.

To avoid costly surprises later, get as much financial clarity as possible before signing. Consider using audited or independently reviewed financials prepared specifically for the sale, and if available, review a seller-commissioned due diligence report. These steps help ensure that the locked box date balance sheet is both accurate and credible, allowing everyone to enter the deal with greater confidence.

Define leakage with precision and examples.

Clearly define what constitutes leakage, using examples that are common in practice — such as dividends, repayment of shareholder loans, non-arm's-length transactions with affiliates or bonuses paid outside the ordinary course of business. These typically include payments or transactions that would not have occurred if the buyer had already been the economic owner, ensuring that value remains intact between the locked box date and closing.

Conversely, permitted payments — like routine payroll, supplier invoices or expenditures directly tied to ordinary-course operations — should also be explicitly outlined to avoid unnecessary disputes.

Consider how leakage will be monitored: Specify the types of records, such as bank reconciliations, general ledgers or audit rights, that the buyer can use to confirm compliance. By aligning definitions and remedies with practical enforcement mechanisms, parties can avoid ambiguity and foster smoother collaboration after signing.

Align terms with timing and market conditions

Choose a locked box date that's recent enough to reflect the company's current state, especially if completion might be delayed. By minimizing how far back you set the financial snapshot, both private equity sellers and strategic buyers can trust that the agreed purchase price won't be undermined by changing business conditions or market volatility.

Agree to clear enforcement remedies.

Backstop leakage protections with transparent remedies such as indemnities or escrow funds. Keep the claim period relatively short to encourage prompt resolution of any issues.

Consider having no de minimis threshold for leakage claims to ensure that even small breaches are addressed swiftly, preserving the credibility and integrity of the locked box structure.

Looking Forward

The first time I negotiated a deal using a lockbox mechanism, the experience fundamentally changed the way I viewed M&A price adjustment structures.

Instead of bracing for the late-stage squabbles that so often followed closing, we resolved key financial issues in advance. The lockbox mechanism presents a compelling alternative to the postclosing price adjustments that dominate U.S. transactions.

For private equity sponsors, it offers a direct path from closing to value creation, eliminating distractions and enabling faster portfolio optimization. For strategic acquirers, it provides price certainty, paving the way for seamless integration and accelerated synergy capture.

As U.S. markets evolve, driven by a growing demand for efficiency and transparency, the lockbox is strategically poised to overcome historical inertia. By simplifying deal execution and fostering trust between parties, the lockbox allows dealmakers to focus on achieving the strategic objectives that define the transaction's success.

If you're looking to cut down on complexity and streamline your deal process, it's worth exploring how a lockbox could unlock new value in your next transaction.

Read more